Sign up before december 15!

|

|

|

|

OPL is here to help you navigate the process of finding the right insurance coverage for you and your family. Check out the links below for more information.

Important notes:

Affordability:

•85% of marketplace enrollees qualify for a tax credit

•Financial security: avoid big medical bills, peace of mind

•Most shoppers can find health insurance for less than $100/month

Premiums Are Dropping:

•National average drop of 1.5 percent in premiums

•First time premium prices have fallen since 2014

What this means for consumers:

•Subsidized coverage will look mostly the same

•Consumers who make too much money for tax credits will benefit the most

Insurer Participation is on the rise:

There will be 23 more insurers participating in HealthCare.Gov states → Anthem, Wellmark, Molina and Cigna all returning

•39 percent of counties will have a single insurer (down from 56 percent of counties last year)

•Five states - AK, DE, MS, NE, and WY - will have only one insurer (down from 10 states last year)

•58 percent of enrollees in the 39 HealthCare.Gov states will have 3 or more insurers to choose from

•85% of marketplace enrollees qualify for a tax credit

•Financial security: avoid big medical bills, peace of mind

•Most shoppers can find health insurance for less than $100/month

Premiums Are Dropping:

•National average drop of 1.5 percent in premiums

•First time premium prices have fallen since 2014

What this means for consumers:

•Subsidized coverage will look mostly the same

•Consumers who make too much money for tax credits will benefit the most

Insurer Participation is on the rise:

There will be 23 more insurers participating in HealthCare.Gov states → Anthem, Wellmark, Molina and Cigna all returning

•39 percent of counties will have a single insurer (down from 56 percent of counties last year)

•Five states - AK, DE, MS, NE, and WY - will have only one insurer (down from 10 states last year)

•58 percent of enrollees in the 39 HealthCare.Gov states will have 3 or more insurers to choose from

Five things to know about open enrollment:

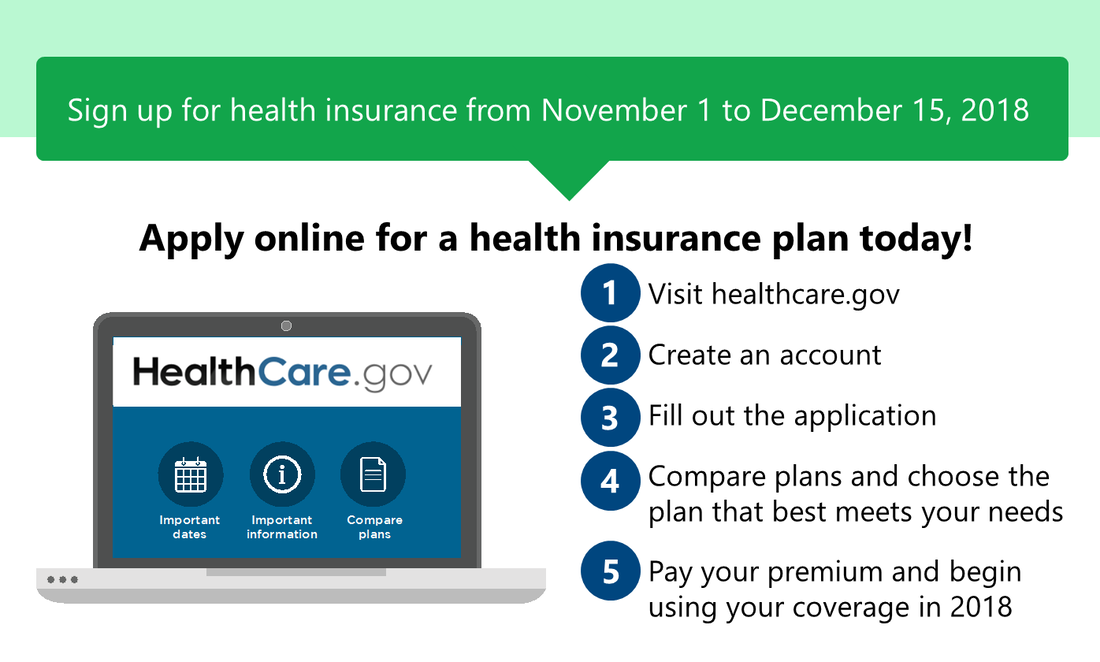

1. When: November 1, 2018 - December 15, 2018 (some states may extend their

deadlines, but in order to have coverage that begins January 1, you must enroll by

December 15)

2. Where: HealthCare.Gov Always start with HealthCare.Gov. If your state uses their

own website, HealthCare.Gov will guide you there. HealthCare.Gov or your

state-based marketplace can only sell ACA plans, so you can rest easy knowing

you’re getting a comprehensive plan that will be there for you when you need it.

3. What: Comprehensive coverage at an affordable price . HealthCare.Gov plans

must include key benefits like mental health care, maternity care, prescription

drug coverage and hospitalization services. In addition to good coverage, most

marketplace shoppers will qualify for a discount based on their income. Last year,

more than 8 in 10 shoppers could get a plan for less than $100/month.

4. Why: Peace of mind. Financial security. Access to comprehensive care. There

are so many reasons to sign up for affordable, comprehensive coverage, join the

millions who have gained health insurance thanks to the ACA!

5. How: Enroll online, over the phone, or in-person . Log on to the official ACA

marketplace at HealthCare.Gov, or CuidadodeSalud.Gov, call the marketplace call

center at 1-800-318-2596, or make an appointment for in-person through the Get

Covered Connector

deadlines, but in order to have coverage that begins January 1, you must enroll by

December 15)

2. Where: HealthCare.Gov Always start with HealthCare.Gov. If your state uses their

own website, HealthCare.Gov will guide you there. HealthCare.Gov or your

state-based marketplace can only sell ACA plans, so you can rest easy knowing

you’re getting a comprehensive plan that will be there for you when you need it.

3. What: Comprehensive coverage at an affordable price . HealthCare.Gov plans

must include key benefits like mental health care, maternity care, prescription

drug coverage and hospitalization services. In addition to good coverage, most

marketplace shoppers will qualify for a discount based on their income. Last year,

more than 8 in 10 shoppers could get a plan for less than $100/month.

4. Why: Peace of mind. Financial security. Access to comprehensive care. There

are so many reasons to sign up for affordable, comprehensive coverage, join the

millions who have gained health insurance thanks to the ACA!

5. How: Enroll online, over the phone, or in-person . Log on to the official ACA

marketplace at HealthCare.Gov, or CuidadodeSalud.Gov, call the marketplace call

center at 1-800-318-2596, or make an appointment for in-person through the Get

Covered Connector

Dispelling Myths

There’s a lot of confusion among both the remaining uninsured and current marketplace

consumers about what exactly has changed, what hasn’t, and what are the best options

for enrolling in coverage. We’re busting some of the most common myths about the ACA

- check them out below.

Myth #1: Financial help to lower premiums and out-of-pocket costs is no longer

available. FALSE . Financial assistance is still available for low and middle-income

consumers to help lower the cost of their plan. In fact, more than 8 out of 10 consumers

last year qualified for a tax credit.

Myth #2: The marketplace is not stable and premiums are skyrocketing. FALSE . In fact,

premium price increases for 2019 are expected to be much lower than previous years,

and some states will even see price decreases. CMS recently announced a national

average drop of 1.5 percent in premiums across states using HealthCare.Gov.

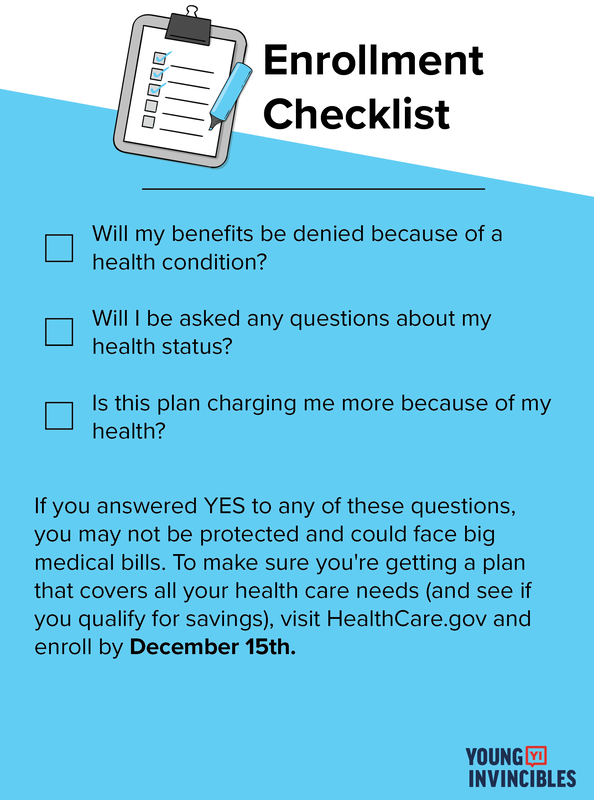

Myth #3: I am no longer protected from discrimination for having a pre-existing

condition. FALSE . All of the consumer protections created by the ACA are still intact, and

all plans sold by HealthCare.Gov must provide comprehensive coverage, and cannot

charge a consumer more because of their health status or medical history. Plans outside

the ACA marketplace don’t have to offer the same protections, so always make sure to

use HealthCare.Gov when enrolling in coverage.

Myth #4: Insurers are dropping out . FALSE . In fact, the highest number of insurers are

participating this year since 2015. There will be 23 more insurers participating in

HealthCare.Gov states and 29 insurers are expanding their coverage to additional

counties in 2019 compared to 2018. Overall 58 percent of enrollees in all 39 states using

HealthCare.Gov will have three or more insurers to choose from. That means more

choices and competitive prices for consumers.

consumers about what exactly has changed, what hasn’t, and what are the best options

for enrolling in coverage. We’re busting some of the most common myths about the ACA

- check them out below.

Myth #1: Financial help to lower premiums and out-of-pocket costs is no longer

available. FALSE . Financial assistance is still available for low and middle-income

consumers to help lower the cost of their plan. In fact, more than 8 out of 10 consumers

last year qualified for a tax credit.

Myth #2: The marketplace is not stable and premiums are skyrocketing. FALSE . In fact,

premium price increases for 2019 are expected to be much lower than previous years,

and some states will even see price decreases. CMS recently announced a national

average drop of 1.5 percent in premiums across states using HealthCare.Gov.

Myth #3: I am no longer protected from discrimination for having a pre-existing

condition. FALSE . All of the consumer protections created by the ACA are still intact, and

all plans sold by HealthCare.Gov must provide comprehensive coverage, and cannot

charge a consumer more because of their health status or medical history. Plans outside

the ACA marketplace don’t have to offer the same protections, so always make sure to

use HealthCare.Gov when enrolling in coverage.

Myth #4: Insurers are dropping out . FALSE . In fact, the highest number of insurers are

participating this year since 2015. There will be 23 more insurers participating in

HealthCare.Gov states and 29 insurers are expanding their coverage to additional

counties in 2019 compared to 2018. Overall 58 percent of enrollees in all 39 states using

HealthCare.Gov will have three or more insurers to choose from. That means more

choices and competitive prices for consumers.